by Team SKM | Jan 15, 2026 | Updates

As the Union Budget approaches, equity markets are not positioning for fireworks in the power and energy space. Instead, expectations are anchored around continuity – reinforcing policy direction rather than announcing headline-grabbing allocations. Most...

by Team SKM | Jan 12, 2026 | Updates

Taxpayers often look to reinvest the proceeds from the sale of a residential house into new property while minimizing capital gains tax and planning succession for their children. A common question is whether two adjoining flats can be purchased using the sale...

by Team SKM | Jan 10, 2026 | Updates

2025 did not deliver one headline reform.It delivered many, in quick succession. Over the course of the year, India pushed through changes that normally arrive over several budget cycles. Some were triggered by global pressures. Others reflected long-pending domestic...

by Team SKM | Jan 8, 2026 | Updates

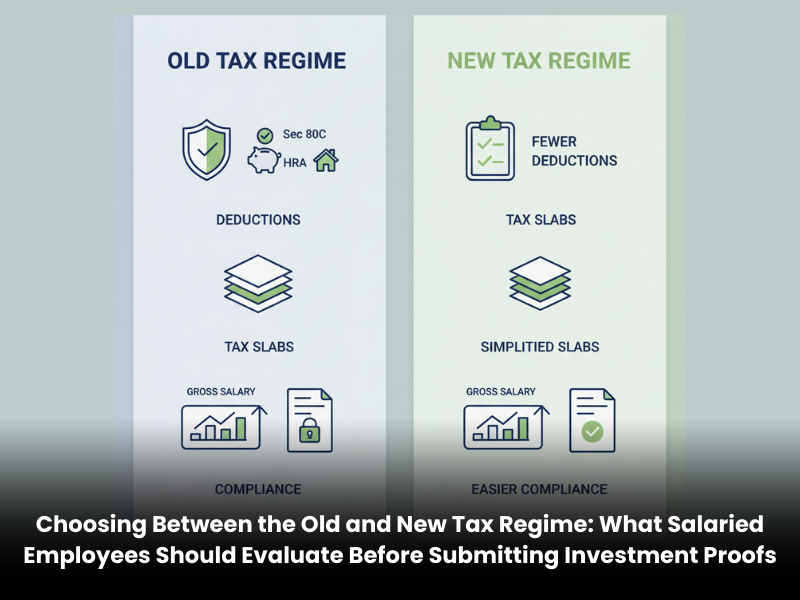

As employers begin the annual process of collecting investment declarations and proofs, salaried employees are required to indicate whether they wish to be taxed under the old tax regime or the new tax regime for TDS purposes. This is not a mere administrative choice....

by Team SKM | Jan 7, 2026 | Updates

As preparations for Union Budget 2026 gather pace, the taxation of virtual digital assets (VDAs) has once again come into focus. Since 2022, India has adopted a strict tax-first approach to crypto assets, characterised by high tax rates, transaction-level levies, and...