by Team SKM | Feb 3, 2026 | Updates

The new India–US trade agreement does more than cut duties. It resets how the two countries engage on market access, energy sourcing and supply chains. The deal ends a year of tariff escalation and links trade concessions to broader geopolitical negotiations. How the...

by Team SKM | Feb 1, 2026 | Updates

Budget 2026 does not read like a relief package. It reads like a design document for how the Indian economy is expected to scale over the next decade. At first glance, it looks like a familiar mix of sector schemes and policy missions. But beneath the surface, the...

by Team SKM | Jan 29, 2026 | Updates

The Economic Survey is one of the most important policy documents released by the Government of India every year. It is presented in Parliament a day before the Union Budget and acts as a report card on the state of the Indian economy. While the Budget tells you what...

by Team SKM | Jan 28, 2026 | Updates

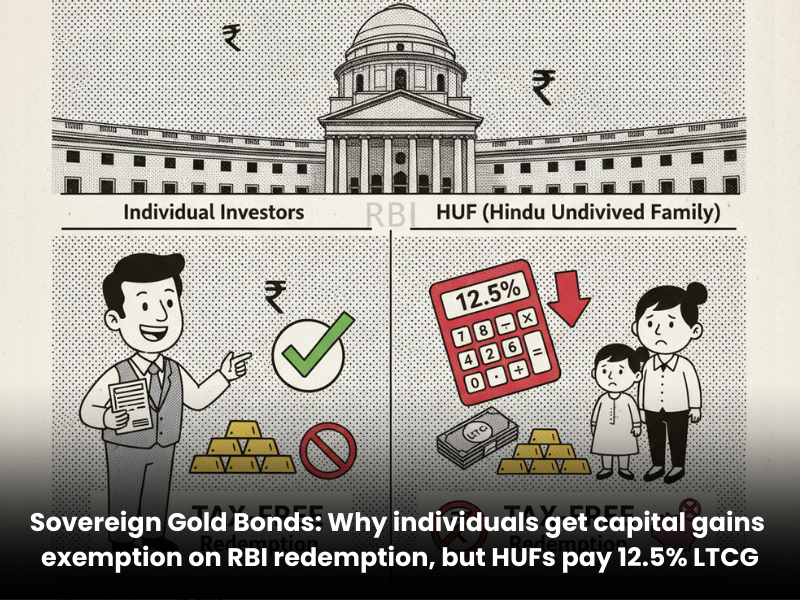

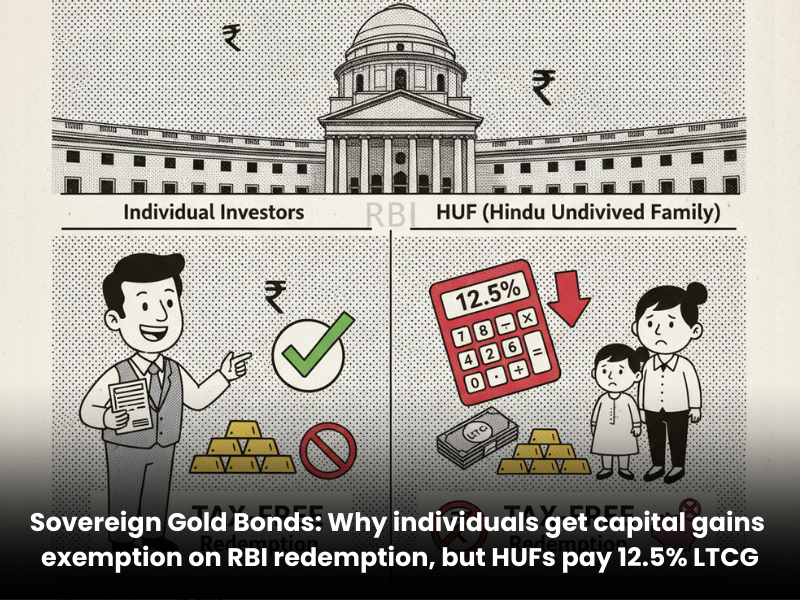

Overview: what creates the difference Sovereign Gold Bonds (SGBs) have a unique tax benefit that applies only in a specific situation. When an SGB is redeemed with the Reserve Bank of India (RBI), the Income Tax Act provides a capital gains exemption for individual...

by Team SKM | Jan 27, 2026 | Updates

On January 27, 2026, India and the European Union (EU) successfully concluded negotiations on a landmark Free Trade Agreement (FTA) – being hailed as the “Mother of All Trade Deals” for India. This historic pact dramatically alters how India trades with one of...

by Team SKM | Jan 21, 2026 | Updates

A major reshaping of the global job market is already underway, and it’s accelerating. According to the World Economic Forum’s Future of Jobs Report 2025, the next five years will bring the sharpest churn in employment the world has seen in decades. Technology,...