Filing your Income Tax Return (ITR) is more than a yearly obligation – it’s an opportunity to reflect on your financial discipline. Yet every year, many taxpayers, including salaried individuals, business owners, and even professionals, repeat the same avoidable mistakes. As someone who has observed these patterns closely, I believe it’s not the complexity of the tax system that causes trouble – it’s our haste, assumptions, and overconfidence that do.

Let’s take a closer look at the common ITR filing mistakes – and why they matter more than you might think.

1. Choosing the Wrong ITR Form

This is perhaps the most frequent misstep. Many taxpayers file ITR-1 because it seems “easiest,” even when they have capital gains, freelance income, or multiple house properties – all of which make them ineligible. Filing with the wrong form can lead to a “defective return” notice and unnecessary stress.

Thought: Filing the simplest form doesn’t make your tax journey simpler – correctness does.

2. Not Reporting All Income Sources

Interest from fixed deposits, savings bank accounts, or rental income often gets “forgotten.” But the Income Tax Department has your Form 26AS and AIS, and it’s smarter than ever before.

Opinion: Omitting income doesn’t reduce your tax; it reduces your credibility.

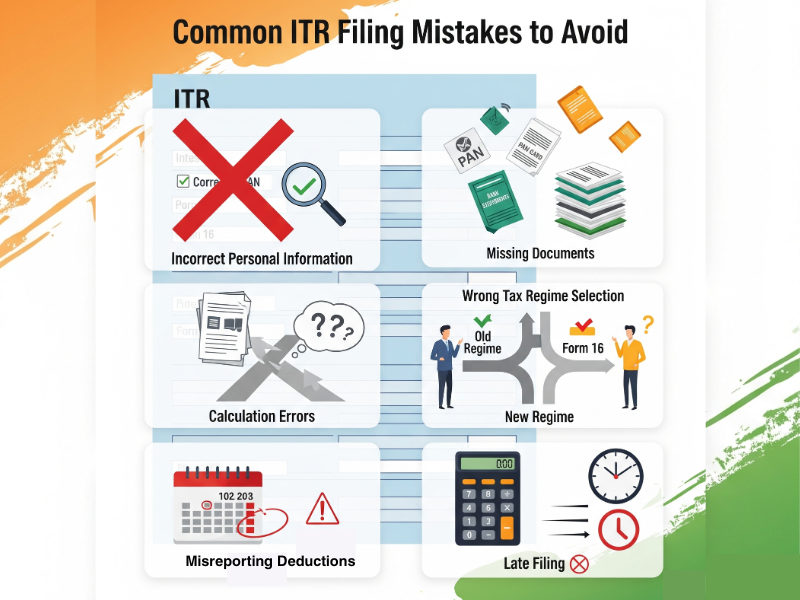

3. Incorrect Bank Details or PAN/Aadhaar Mismatch

Imagine completing your return perfectly – only for your refund to fail due to a small typo in your bank details. PAN-Aadhaar mismatches also delay processing.

Tip: Cross-verify basic details – these little things have big consequences.

4. Forgetting to Verify the ITR

Just submitting the return isn’t enough. You must e-verify it within 30 days. Many forget this last step, which invalidates the entire return.

Perspective: E-verification is the signature on your financial statement – don’t forget to sign.

5. Over claiming or Misreporting Deductions

It’s tempting to stretch deductions under 80C or 80D, but misreporting invites scrutiny. Claim only what you can support with documents.

Lesson: Tax savings are good; tax truthfulness is better.

Final Thought

Filing your ITR isn’t just a compliance formality – it’s a reflection of your financial honesty. In a digital and interconnected tax ecosystem, carelessness costs more than ever. As taxpayers, we owe it to ourselves to be accurate, transparent, and timely.

Let this year be different. File your return not in a rush, but with responsibility. Because when it comes to taxes, the smartest move is the most honest one.